In the context of the digital economy during the 2026–2030 period, digital transformation is no longer an optional enhancement but has become a survival mandate and a core growth lever for small and medium‑sized enterprises (SMEs) in Vietnam. As both international and domestic markets grow increasingly volatile, traditional management and operating models are revealing critical limitations in speed, scalability, and efficiency.

The comprehensive digital transformation solutions and roadmap proposed in this document go beyond the mere adoption of technology. Instead, they focus on fundamental shifts in strategic mindset and organizational capabilities. The ultimate objective is to enable SMEs to optimize operational processes, enhance customer experience, and build sustainable competitive advantages. This roadmap serves as a critical launchpad for Vietnamese enterprises to scale confidently and proactively capture new opportunities in an era of deep and pervasive digitalization.

1. Executive Overview and Macroeconomic Context in 2026

1.1. Economic Landscape and the Role of SMEs in the New Era

Entering fiscal year 2026, Vietnam’s economy is operating on a renewed growth trajectory, reinforced by the strong achievements of the 2021–2025 period. According to the latest official statistics, GDP growth in 2025 reached 8.02%, placing Vietnam among the fastest‑growing economies in the region over the five‑year average. This robust recovery not only signals macroeconomic stability but also reflects the high adaptability of the Vietnamese business community amid global uncertainties.

Within this economic structure, SMEs—accounting for over 95% of all active enterprises—continue to serve as the backbone of the national economy, acting as the primary engine for job creation and a major contributor to GDP. However, the business environment in 2026 presents fundamentally different challenges compared to the first half of the decade.

Whereas digital transformation was previously viewed as a competitive advantage for early adopters, it has now become a “license to operate.” Pressure from next‑generation free trade agreements, stringent supply chain transparency requirements, and—most critically—shifts in digital consumer behavior have compelled SMEs to restructure their operating models. Furthermore, the convergence of digital transformation and green transformation (the “Twin Transition”) is introducing new technical and compliance barriers. Enterprises must now demonstrate not only operational efficiency but also sustainability performance through verifiable, digitized data.

1.2. The Shift from “Ad Hoc Adoption” to “Compliance‑Driven and Strategic Transformation”

A defining characteristic of the digital transformation landscape in 2026 is the shift in underlying drivers. During the 2020–2024 period, digital initiatives were largely ad hoc, experimental, and often discontinued due to limited financial and human resources. In contrast, 2026 is shaped by compliance pressure.

New government regulations—such as electronic invoices generated from point‑of‑sale systems, real‑time tax data integration, labor reporting via the national digital identity platform (VNeID), and mandatory product traceability—have created a non‑negotiable push toward digitization.

As one SME director in Hanoi aptly stated:

> “For small businesses, digital transformation is first and foremost about meeting the conditions to survive.”

This perspective demonstrates a clear shift in business awareness. Technology is no longer a discretionary investment but has become foundational infrastructure, comparable to electricity or water. This report therefore focuses on converting compliance pressure into a growth catalyst, enabling SMEs not only to survive but to move up the global value chain.

2. Legal and Policy Framework for Strategic Support (2026–2030)

The year 2026 marks the beginning of a new national policy cycle with a strategic horizon extending to 2030. The Vietnamese Government, together with leading local authorities such as Ho Chi Minh City, has issued a series of legal instruments and support programs, forming a coherent regulatory ecosystem to accelerate digital transformation.

2.1. Decision No. 84/QĐ‑TTg: A Catalyst for Legal Support and Digital Access

On January 14, 2026, Deputy Prime Minister Hồ Quốc Dũng signed Decision No. 84/QĐ‑TTg, approving the Inter‑sectoral Legal Support Program for Small and Medium‑Sized Enterprises and Household Businesses (2026–2030). This decision represents more than an administrative measure—it is a strong political commitment to the digitalization of public services for businesses.

Key quantitative targets highlight the Government’s determination:

- Digital access to legal information:

100% of SMEs and household businesses must have access to basic legal information, with at least 80% delivered via digital platforms. This implies a gradual phase‑out of paper‑based and face‑to‑face channels, requiring enterprises to develop digital literacy and infrastructure. - Online consultation and issue resolution:

At least 80% of consultation requests submitted through the program must be resolved or escalated for formal handling. This necessitates two‑way digital interaction, encouraging the adoption of electronic documents and digital signatures. - Open and integrated legal data:

100% of legal databases are to be built and integrated into the National Legal Portal, providing free access for enterprises and substantially reducing compliance costs, one of the largest structural burdens for SMEs.

Strategically, Decision 84/QĐ‑TTg transforms the role of government from “regulator” to “digital enabler and service provider.” For SMEs, it unlocks access to high‑quality legal resources that were previously affordable only to large corporations with in‑house legal teams or external law firms.

2.2. Ho Chi Minh City’s Targeted Strategy: Leading the Transformation Agenda

As Vietnam’s most dynamic economic hub, Ho Chi Minh City has approved the SME, private enterprise, and household business support plan for 2026–2028 under Decision No. 175/QĐ‑UBND. This plan demonstrates a clear segmentation of beneficiaries and tailored intervention mechanisms.

2.2.1. Transitioning Household Businesses into Formal Enterprises

A key strategic focus is encouraging high‑potential household businesses to formalize into registered enterprises. This largely informal sector exhibits a low level of digital maturity. Formalization not only expands the official economy but also enables these entities to adopt structured digital management platforms such as ERP and CRM, replacing manual bookkeeping practices.

2.2.2. Interest Rate Subsidies under Resolution No. 09/2023/NQ‑HĐND

Ho Chi Minh City continues to deploy a powerful financial instrument under Resolution No. 09/2023/NQ‑HĐND. Projects involving high technology investment, digital transformation, and innovation‑driven startups are eligible for interest rate subsidies via the Ho Chi Minh City Finance and Investment State‑owned Company (HFIC).

- Support level: Up to 100% or 50% of loan interest rates, depending on priority sectors

- Loan cap: Interest‑subsidized loans of up to VND 200 billion per project

- Impact: This mechanism acts as a critical financial de‑risking lever, enabling SMEs to invest in capital‑intensive digital projects with long payback periods.

2.2.3. Public–Private Partnerships in Digital Enablement

The Ho Chi Minh City Department of Information and Communications has partnered with major technology corporations (Viettel, VNPT) and industry associations (HUBA, HCA) to deliver free digital transformation support packages for approximately 2,000 SMEs. Solutions such as digital workplaces (e.g., Viettel‑CODX) help enterprises reduce operating costs while accelerating digital adoption and workforce readiness.

2.3. Other National Strategic Directions

Beyond Decision 84, the 2026 policy landscape is reinforced by key resolutions and national programs:

- Resolution No. 57‑NQ/TW:

Emphasizes breakthroughs in science, technology, innovation, and national digital transformation, formally recognizing digitalization as a primary growth engine and mandating priority resource allocation. - Sustainable Business Support Program (Decision No. 167/QĐ‑TTg):

Integrates digital transformation with ESG and sustainability objectives, targeting support for 10,000 private enterprises adopting sustainable business models. - Tax and Customs Modernization Policies:

The Ministry of Finance’s 2026 legal support plan prioritizes electronic tax administration and digital customs procedures, significantly increasing financial data transparency and governance requirements for enterprises.

3. Financial Ecosystem Analysis: Unlocking Capital for Digital Transformation

One of the most significant barriers facing SMEs in their digital transformation journey is limited access to capital. Intangible assets—such as software, data, and digitalized processes—are typically not accepted by banks as collateral. However, 2026 marks a fundamental shift in the banking sector’s credit approach, moving away from asset‑based lending toward data‑based lending and supply chain finance (SCF) models.

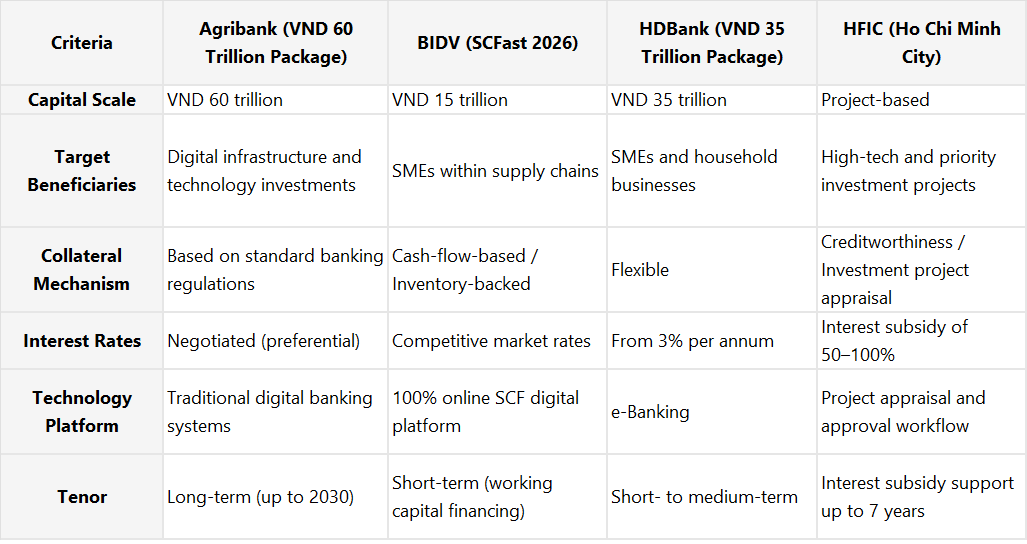

3.1. Strategic Credit Programs from the Banking System

3.1.1. Agribank: Long‑Term Capital for Digital Infrastructure

The Vietnam Bank for Agriculture and Rural Development (Agribank) has taken a pioneering role by launching a preferential credit package totaling VND 60 trillion, dedicated specifically to enterprise investments in digital infrastructure and technology.

- Tenor: The program runs until December 31, 2030, demonstrating Agribank’s long‑term commitment to accompanying the national digital transformation agenda.

- Scope of financing: Unlike traditional loan products, this package is not limited to software procurement. It also covers:

- Greenfield digital projects

- Mergers and acquisitions of technology projects

- Refinancing of previously incurred digital investment costs

This approach directly addresses the “capital starvation” challenge faced by manufacturing SMEs seeking to invest in automation lines, large‑scale ERP systems, or smart factory initiatives.

- Strategic significance:

With total assets exceeding USD 100 billion and an extensive nationwide branch network, Agribank’s participation ensures that digital capital reaches rural, remote, and underserved SME segments, reinforcing the principle of inclusive digital transformation.

3.1.2. BIDV: Breakthrough Digital Supply Chain Finance (SCF)

The Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) continues to assert its leadership in banking technology through the BIDV SCFast 2026 Program, with a total scale of VND 15 trillion.

- Operating mechanism:

Instead of requiring standalone collateral from SMEs, BIDV provides financing based on the credit profile and cash flows of anchor enterprises within the supply chain—typically large conglomerates or FDI corporations. SMEs participating as suppliers or distributors (satellite firms) benefit directly from this structure. - Key advantages:

- Financing of up to 85% of purchase order or invoice value

- Collateral requirements reduced to below 10%, significantly lower than conventional lending

- Acceptance of circulating inventory as collateral—an asset commonly held by SMEs but rarely bankable under traditional credit policies

- End‑to‑end digital platform:

- A core differentiator of the program is the BIDV SCF digital platform, which enables the entire financing process—registration, approval, disbursement, and transaction management—to be conducted fully online.

- This reduces time‑to‑capital from weeks to hours, aligning perfectly with SMEs’ short‑cycle working capital needs.

3.1.3. HDBank: Competitive Interest Rates for SMEs

HDBank has entered the market with a VND 35 trillion credit package offering preferential interest rates starting from as low as 3% per annum. In an environment of fluctuating capital costs, such rates provide tangible and immediate relief, allowing SMEs to redirect financial resources toward innovation and digital capability building rather than debt servicing.

3.2. The Convergence of Green Finance and Digital Finance

A defining trend in 2026 is the mutual reinforcement between “Green” and “Digital” finance. To access preferential loan programs—such as the 2% interest subsidy scheme or international green funding sources—enterprises must demonstrate measurable Environmental, Social, and Governance (ESG) performance indicators.

Barrier:

ESG compliance cannot be credibly demonstrated through manual, paper‑based reporting. It requires transparent, verifiable data flows, collected and processed through digital systems such as:

- IoT‑based energy monitoring

- Waste and emissions management software

- Digital ESG reporting platforms

Opportunity:

As a result, digital transformation becomes a prerequisite for green financing. Banks are increasingly leveraging digital data to enhance credit scoring accuracy, opening access to capital for enterprises with sound financial fundamentals but limited tangible assets.

Digital maturity, therefore, is no longer solely an operational advantage—it has become a financial passport, enabling SMEs to participate in blended finance, green credit programs, and global sustainability‑linked value chains.

Summary Table: Key Credit Programs in 2026 (to be developed)

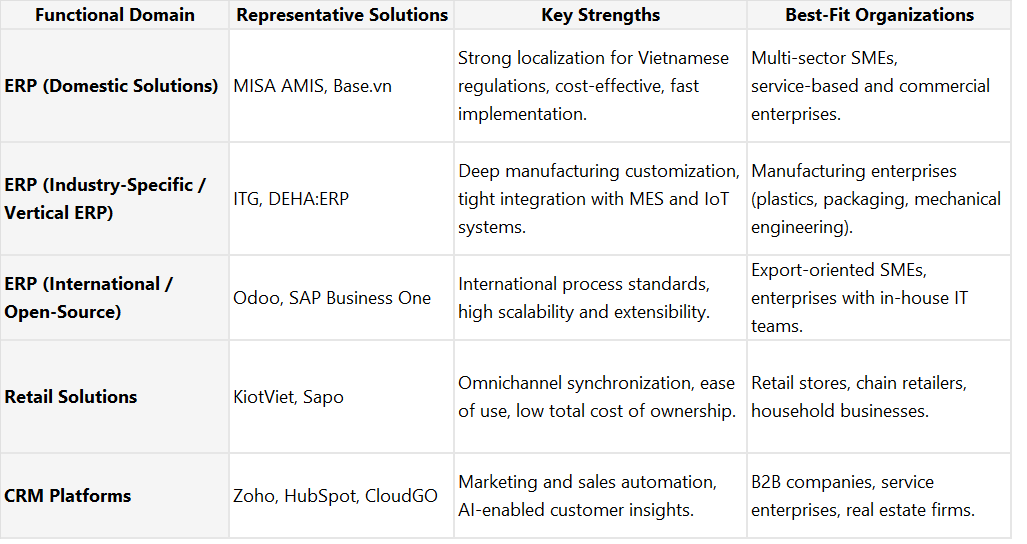

4. Technology Solution Map: Digital Enterprise Architecture for 2026

By 2026, the technology solutions market has reached a high level of maturity, with clear segmentation and differentiated value propositions tailored to specific enterprise sizes. The dominant trends shaping this landscape are Software‑as‑a‑Service (SaaS), cloud‑native architectures, and AI‑driven operations.

4.1. Enterprise Resource Planning (ERP): The Core Engine of Digital Transformation

ERP systems are no longer the exclusive domain of large corporations. Vendors have significantly refined their offerings to align with the budget constraints and operational scale of SMEs, making ERP the backbone of digital transformation even for smaller organizations.

4.1.1. Domestic “Make in Vietnam” Solutions: The Rise of Localization Advantage

Vietnamese ERP solutions dominate the SME segment due to their deep understanding of Vietnam Accounting Standards (VAS), local tax regulations, and indigenous management practices.

MISA AMIS

Widely regarded as the most popular unified enterprise management platform in Vietnam. MISA’s key strength lies in its finance–accounting ecosystem, which is directly integrated with the General Department of Taxation and commercial banking systems.

By 2026, MISA AMIS has extensively embedded AI capabilities for automated journal entries and cash‑flow forecasting. MISA eShop has also been recognized as a leading solution in the retail sector.

Base.vn

Approaches the market from an operations management perspective. Rather than focusing on finance like MISA, Base excels in workflow automation, document management, and human resource management (HRM). This makes it an optimal choice for service‑oriented enterprises and office‑based organizations that require high operational flexibility.

Vertical ERP Solutions

Providers such as DEHA:ERP and ITG deliver highly customized, industry‑specific ERP solutions for manufacturing sectors such as plastics, packaging, electronics, and mold making. Their competitive advantage lies in deep integration with Manufacturing Execution Systems (MES) and the ability to manage complex Bills of Materials (BOMs)—capabilities that off‑the‑shelf (COTS) ERP products often struggle to support.

4.1.2. Open‑Source and International Solutions: Flexibility and Global Standards

Odoo

Maintains its position as the world’s leading open‑source ERP for SMEs. Its highly modular architecture enables enterprises to start with a limited number of applications (e.g., CRM, inventory) and scale incrementally.

The main barrier, however, is the need for a technically competent team to customize and localize workflows to Vietnamese business and regulatory requirements.

SAP Business One / Oracle NetSuite

Target upper‑SMEs and mid‑market enterprises, particularly those operating within global supply chains that require IFRS‑compliant reporting. While the total cost of ownership is higher, these platforms deliver unmatched stability, scalability, and enterprise‑grade governance.

4.2. Customer Experience Management and Omnichannel Sales (CRM & Omnichannel)

By 2026, sales is no longer defined by discrete transactions but by a continuous customer journey across online and offline touchpoints (O2O).

Sapo & Haravan – Market Leaders in Retail Technology

Sapo stands out for its real‑time inventory synchronization across e‑commerce marketplaces (Shopee, TikTok Shop) and physical stores, effectively eliminating stock discrepancies.

Haravan is strong in marketing automation and social commerce, with deep integrations into payment gateways (e.g., Payoo) and logistics providers, enabling end‑to‑end order management.

KiotViet

Remains the top choice for small stores and household businesses due to its extremely intuitive interface, optimized for point‑of‑sale operations and designed for users with limited digital literacy.

Next‑Generation CRM Platforms

Solutions such as Zoho CRM, HubSpot, and CloudGO are increasingly embedding AI‑powered automation into customer lifecycle management.

For example, AI‑based lead scoring automatically prioritizes high‑conversion prospects from social channels, allowing sales teams to focus on the most valuable opportunities.

4.3. Intelligent Finance and Accounting Solutions

MISA SME 2026

The latest version places strong emphasis on budgeting and cash‑flow governance. Granular departmental budgeting capabilities allow business owners to monitor financial health more rigorously in an increasingly volatile economic environment.

Bank Integration (BankHub)

The rise of Embedded Banking enables accountants to initiate fund transfers, check balances, and reconcile bank statements directly within accounting software—without logging into separate e‑banking systems.

This integration significantly reduces operational errors and fraud risks while improving financial process efficiency.

Comparison Table: Technology Solution Categories in 2026 (to be developed)

5. Sector‑Specific Digital Transformation Roadmaps

Each industry operates under distinct structural and operational characteristics; therefore, there is no one‑size‑fits‑all digital transformation formula. Based on practical market observations in 2026, this report proposes tailored roadmaps for three major industry groups.

5.1. Retail & Trading

- Key challenges:

Omnichannel inventory management, price competition, customer retention, and margin pressure. - Recommended roadmap:

- Phase 1 – Core Digitization:

Deploy Point‑of‑Sale (POS) systems (e.g., KiotViet, Sapo) at physical outlets. Adopt cashless payments (QR code, e‑wallets) to improve transaction efficiency and compliance. - Phase 2 – Expansion and Integration:

Build online sales channels (own website, e‑commerce marketplaces) fully synchronized with the POS system. Implement CRM platforms to manage customer data and loyalty programs. - Phase 3 – Advanced Optimization:

Apply AI‑driven personalization for promotions and recommendations. Leverage consumer behavior analytics to optimize demand forecasting and inventory replenishment.

- Phase 1 – Core Digitization:

5.2. Manufacturing and Processing

- Key challenges:

Bills of Materials (BOM) management, production planning, traceability, and operational transparency. - Recommended roadmap:

- Phase 1 – Core Digitization:

Digitize warehouse operations and production accounting using ERP solutions (e.g., MISA, DEHA). Manage BOM structures directly within the system to eliminate manual errors. - Phase 2 – Operational Optimization:

Implement Material Requirements Planning (MRP) systems. Integrate inbound and outbound e‑invoicing to streamline tax compliance and cost tracking. - Phase 3 – Intelligent Operations:

Deploy a baseline Smart Factory model. Utilize IoT sensors for real‑time machine monitoring and predictive maintenance. Integrate Blockchain‑based traceability to meet export and compliance requirements.

- Phase 1 – Core Digitization:

5.3. Agriculture

- Key challenges:

Climate change risks, export standards, fragmented production, and market access limitations. - Recommended roadmap:

- Phase 1 – Core Digitization:

Digitize farm diaries and cultivation logs. Participate in agricultural e‑commerce platforms to improve market reach. - Phase 2 – Standardization:

Implement digital traceability solutions (e.g., iCheck, VNPT). Manage cooperatives and planting zones on centralized digital platforms. - Phase 3 – High‑Tech Agriculture:

Apply IoT‑based environmental monitoring and automated irrigation systems. Integrate operational data with banking platforms to enable unsecured data‑driven lending.

- Phase 1 – Core Digitization:

6. Human Capital Development and Digital Culture

Even the most advanced technologies are ineffective without people who can operate and scale them. The Digital Skills Gap remains the most significant barrier facing SMEs in 2026.

6.1. Digital Skills Development: From “Operational Use” to “Technology Mastery”

- Leverage National Programs:

The Agency for Enterprise Development (Ministry of Planning and Investment), in cooperation with accredited training providers, delivers in‑person digital transformation courses. Notably, 100% training cost subsidies are available for women‑led enterprises or companies employing large numbers of female workers—an often underutilized strategic resource. - Industry–Academia Collaboration:

Partnerships between the Ho Chi Minh City Digital Transformation Center (DXCenter) and universities such as Saigon International University (SIU) are creating a high‑quality talent pipeline. SMEs should actively collaborate with these institutions by hosting interns to access Gen Z talent with strong digital literacy. - Internal Upskilling and Reskilling:

Rather than hiring expensive external talent, SMEs should prioritize upskilling existing employees. Low‑cost or free e‑learning platforms (MOOCs) are effective tools for spreading foundational knowledge in data analytics, cybersecurity, and enterprise software usage.

6.2. Leadership Mindset Transformation (Digital Leadership)

Digital transformation must start at the top. SME leaders need to evolve from experience‑based management toward data‑driven decision‑making. Executive‑level programs organized by VCCI and industry associations focus on strategic thinking, digital governance, and change leadership—critical enablers for sustainable transformation.

7. Challenges and Risk Management

7.1. The “Compliance Trap”

Many SMEs undertake digital initiatives merely to meet tax or partner requirements (e.g., deploying e‑invoicing software without integration into accounting systems). This results in data silos, increased manual data entry, and limited managerial value.

Mitigation:

Adopt a systems‑thinking approach. Every technology investment should be evaluated based on future integration capabilities (APIs) and long‑term architectural fit.

7.2. Cybersecurity and Data Protection Risks

As enterprises migrate data to the cloud, they face growing risks of data breaches and ransomware attacks.

Mitigation measures:

- Select vendors with internationally recognized security certifications (e.g., ISO 27001).

- Implement regular data backup and recovery procedures.

- Train employees in basic cybersecurity awareness, particularly phishing prevention.

7.3. Vendor Lock‑in Risk

Over‑dependence on a single technology provider can limit flexibility and scalability.

Mitigation:

Prioritize solutions that support easy data export, open standards, or have broad partner ecosystems.

8. Conclusions and Strategic Recommendations

8.1. Conclusion

The year 2026 represents not merely a time marker but a strategic inflection point for Vietnamese SMEs. With strong policy support (Decision No. 84/QĐ‑TTg), abundant financial resources from the banking sector (Agribank, BIDV), and increasingly mature technology infrastructure, the necessary conditions for digital transformation are firmly in place. The sufficient condition lies in enterprise commitment and execution capability.

8.2. Recommended Three‑Step Roadmap for SMEs

To achieve successful transformation with limited resources, SMEs should adhere to the principle:

“Think Big, Start Small, Scale Fast.”

Step 1: Digitization & Compliance (3–6 months)

- Objective:

Achieve 100% regulatory compliance (tax, e‑invoicing, social insurance). - Actions:

Deploy digital signatures, e‑invoicing, and basic accounting software. Standardize customer and product master data.

Step 2: Operational Optimization (6–12 months)

- Objective:

Increase productivity, reduce costs, and integrate processes. - Actions:

Implement CRM (sales), HRM (human resources), and POS (retail). Integrate systems for seamless data flows.

Step 3: Enterprise Transformation (12–24 months)

- Objective:

Enable data‑driven decision‑making and develop new business models.

Actions:

Deploy ERP, Business Intelligence (BI), and AI applications. Integrate deeply into global digital supply chains.

Digital transformation is a long‑term journey requiring resilience, adaptability, and strategic discipline. SMEs that confront challenges honestly, leverage available support wisely, and place people at the center of technology will be the clear winners in Vietnam’s digital economy from 2026 to 2030.

See also:

- Digital Transformation and Cybersecurity Challenges for Small and Medium-sized Enterprises (SMEs) in Vietnam (2025–2026)

- An in‑depth analysis of the non‑technical barriers hindering the digital transformation journey of Vietnamese enterprises.

- Digital Transformation Strategy and Dual Growth Model for Small and Medium Enterprises (SMEs) in Vietnam, 2025–2030

Keywords:

- digital transformation solutions

- digital transformation solutions (dts)

- digital transformation solutions company

- digital transformation solutions and enterprise services

- digital transformation solutions meaning

- digital transformation solutions provider

- digital transformation solutions company

Sources

- Agribank tiên phong cho vay ưu đãi doanh nghiệp đầu tư hạ tầng, công nghệ số, truy cập vào tháng 1 17, 2026, https://thoibaotaichinhvietnam.vn/agribank-tien-phong-cho-vay-uu-dai-doanh-nghiep-dau-tu-ha-tang-cong-nghe-so-189259.html

- Doanh nghiệp nhỏ chuyển đổi số trong áp lực tuân thủ, truy cập vào tháng 1 17, 2026, https://money.vtv.vn/doanh-nghiep-nho-chuyen-doi-so-trong-ap-luc-tuan-thu-109260116094035627.htm

- Xây dựng cơ chế tổ chức thực hiện Chương trình hỗ trợ doanh nghiệp khu vực tư nhân kinh doanh bền vững giai đoạn 2022-2025 – Cổng thông tin quốc gia về đăng ký doanh nghiệp, truy cập vào tháng 1 17, 2026, https://dangkykinhdoanh.gov.vn/vn/tin-tuc/611/6216/xay-dung-co-che-to-chuc-thuc-hien-chuong-trinh-ho-tro-doanh-nghiep-khu-vuc-tu-nhan-kinh-doanh-ben-vung-giai-doan-2022-2025-.aspx

- Chuyển đổi số trong doanh nghiệp nhỏ và vừa: Thách thức và giải pháp, truy cập vào tháng 1 17, 2026, https://dx.moj.gov.vn/chuyen-doi-so-trong-doanh-nghiep-nho-va-vua-thach-thuc-va-giai-phap-929.htm

- Hỗ trợ pháp lý cho doanh nghiệp nhỏ và vừa, hộ kinh doanh, truy cập vào tháng 1 17, 2026, https://thoibaotaichinhvietnam.vn/ho-tro-phap-ly-cho-doanh-nghiep-nho-va-vua-ho-kinh-doanh-190665.html

- Phê duyệt Chương trình hỗ trợ pháp lý liên ngành cho doanh nghiệp nhỏ và vừa, hộ kinh doanh, truy cập vào tháng 1 17, 2026, https://nangluongsachvietnam.vn/d6/vi-VN/news/Phe-duyet-Chuong-trinh-ho-tro-phap-ly-lien-nganh-cho-doanh-nghiep-nho-va-vua-ho-kinh-doanh-6-163-32534

- Doanh nghiệp nhỏ và vừa, hộ kinh doanh được tăng cường hỗ trợ pháp lý đến năm 2030, truy cập vào tháng 1 17, 2026, https://suckhoedoisong.vn/doanh-nghiep-nho-va-vua-ho-kinh-doanh-duoc-tang-cuong-ho-tro-phap-ly-den-nam-2030-169260115185256132.htm

- Tăng cường năng lực pháp lý, đồng hành cùng doanh nghiệp phát triển bền vững trong kỷ nguyên số, truy cập vào tháng 1 17, 2026, https://kiemsat.vn/tang-cuong-nang-luc-phap-ly-dong-hanh-cung-doanh-nghiep-phat-trien-ben-vung-trong-ky-nguyen-so-73834.html

- Doanh nghiệp nhỏ và vừa được hỗ trợ pháp lý toàn diện giai đoạn 2026–2030, truy cập vào tháng 1 17, 2026, https://doanhnhan.congly.vn/doanh-nghiep-nho-va-vua-duoc-ho-tro-phap-ly-toan-dien-giai-doan-2026-2030.html

- 100% doanh nghiệp nhỏ và vừa được tiếp cận thông tin pháp lý cơ bản về hoạt động đầu tư, sản xuất, kinh doanh, truy cập vào tháng 1 17, 2026, https://thanhtra.com.vn/tai-chinh-701717FFD/100-doanh-nghiep-nho-va-vua-duoc-tiep-can-thong-tin-phap-ly-co-ban-ve-hoat-dong-dau-tu-san-xuat-kinh-doanh-fd5a0ea22.html

- Quyết định số 84/QĐ-TTg: Chương trình hỗ trợ pháp lý liên ngành cho doanh nghiệp nhỏ và vừa, hộ kinh doanh – Xây Dựng Chính Sách, Pháp Luật, truy cập vào tháng 1 17, 2026, https://xaydungchinhsach.chinhphu.vn/quyet-dinh-so-84-qd-ttg-chuong-trinh-ho-tro-phap-ly-lien-nganh-cho-doanh-nghiep-nho-va-vua-ho-kinh-doanh-119260115201843316.htm

- TPHCM phê duyệt kế hoạch hỗ trợ doanh nghiệp nhỏ và vừa giai đoạn 2026–2028, truy cập vào tháng 1 17, 2026, https://doanhnghiepvadautu.info.vn/tphcm-phe-duyet-ke-hoach-ho-tro-doanh-nghiep-nho-va-vua-giai-doan-20262028-d52963.html

- TP. Hồ Chí Minh: Từng bước đưa doanh nghiệp nhỏ và vừa tham gia mạng lưới sản xuất và chuỗi giá trị, truy cập vào tháng 1 17, 2026, https://www.vietnam.vn/tp-ho-chi-minh-tung-buoc-dua-doanh-nghiep-nho-va-vua-tham-gia-mang-luoi-san-xuat-va-chuoi-gia-tri

- TP.HCM tung gói hỗ trợ toàn diện cho doanh nghiệp giai đoạn 2026 – 2028 từ vốn, nhân lực đến chuyển đổi số, truy cập vào tháng 1 17, 2026, https://danviet.vn/tphcm-tung-goi-ho-tro-toan-dien-cho-doanh-nghiep-giai-doan-2026–2028-tu-von-nhan-luc-den-chuyen-doi-so-d1394896.html

- TP.HCM mở “đường vốn” xanh: Hỗ trợ 100% lãi suất, vay tối đa 200 tỷ đồng – Baodautu.vn, truy cập vào tháng 1 17, 2026, https://baodautu.vn/tphcm-mo-duong-von-xanh-ho-tro-100-lai-suat-vay-toi-da-200-ty-dong-d467411.html

- Nghị quyết 98 – Đảm bảo các cơ chế, chính sách vượt trội đi vào cuộc sống – Trang tin Điện tử Đảng bộ thành phố Hồ Chí Minh, truy cập vào tháng 1 17, 2026, https://hcmcpv.org.vn/tin-tuc/nghi-quyet-98-dam-bao-cac-co-che-chinh-sach-vuot-troi-di-vao-cuoc-song-1491916715

- TP.HCM hỗ trợ thúc đẩy phát triển Fintech, hướng đến trung tâm tài chính khu vực, truy cập vào tháng 1 17, 2026, https://dost.hochiminhcity.gov.vn/hoat-dong-so-khcn/tphcm-ho-tro-thuc-day-phat-trien-fintech-huong-den-trung-tam-tai-chinh-khu-vuc/

- TP.HCM: 2.000 doanh nghiệp SME được hỗ trợ miễn phí chuyển đổi số, truy cập vào tháng 1 17, 2026, https://nongthonviet.com.vn/tphcm-2000-doanh-nghiep-sme-duoc-ho-tro-mien-phi-chuyen-doi-so.ngn

- SIU hợp tác cùng Trung tâm chuyển đổi số TPHCM đào tạo nhân lực cho giai đoạn 2025-2026 – Trường Đại học Tư thục Quốc tế Sài Gòn, truy cập vào tháng 1 17, 2026, https://siu.edu.vn/siu-hop-tac-cung-trung-tam-chuyen-doi-so-tphcm-dao-tao-nhan-luc-cho-giai-doan-2025-2026/

- Hỗ trợ khoảng 10.000 doanh nghiệp khu vực tư nhân kinh doanh bền vững – Trang tin Điện tử Đảng bộ thành phố Hồ Chí Minh, truy cập vào tháng 1 17, 2026, https://www.hcmcpv.org.vn/tin-tuc/ho-tro-khoang-10-000-doanh-nghiep-khu-vuc-tu-nhan-kinh-doanh-ben-vung-1491890627

- Bộ Tài chính ban hành Kế hoạch hỗ trợ pháp lý cho doanh nghiệp nhỏ và vừa năm 2026, truy cập vào tháng 1 17, 2026, https://www.mof.gov.vn/tin-tuc-tai-chinh/thoi-su/bo-tai-chinh-ban-hanh-ke-hoach-ho-tro-phap-ly-cho-doanh-nghiep-nho-va-vua-nam-2026

- Agribank tiếp tục hoạt động an toàn, hiệu quả và số hóa trong năm 2026, truy cập vào tháng 1 17, 2026, https://tuoitre.vn/agribank-tiep-tuc-hoat-dong-an-toan-hieu-qua-va-so-hoa-trong-nam-2026-20260116144030989.htm

- BIDV SCFast 2026 – Giải pháp toàn diện hỗ trợ doanh nghiệp trong chuỗi cung ứng, truy cập vào tháng 1 17, 2026, https://kiemsat.vn/bidv-scfast-2026-giai-phap-toan-dien-ho-tro-doanh-nghiep-trong-chuoi-cung-ung-73831.html

- BIDV SCFast 2026 – Giải pháp toàn diện hỗ trợ doanh nghiệp trong chuỗi cung ứng, truy cập vào tháng 1 17, 2026, https://dantri.com.vn/kinh-doanh/bidv-scfast-2026-giai-phap-toan-dien-ho-tro-doanh-nghiep-trong-chuoi-cung-ung-20260115165343826.htm

- HDBank đồng hành cùng doanh nghiệp với gói tín dụng 35.000 tỷ đồng, lãi suất ưu đãi từ 3%/năm – Báo Chính phủ, truy cập vào tháng 1 17, 2026, https://baochinhphu.vn/hdbank-dong-hanh-cung-doanh-nghiep-voi-goi-tin-dung-35000-ty-dong-lai-suat-uu-dai-tu-3-nam-102250508164622965.htm

- Khơi thông “mạch máu” vốn xanh: Cánh cửa bứt phá cho doanh nghiệp nhỏ và vừa năm 2026, truy cập vào tháng 1 17, 2026, https://vtv.vn/khoi-thong-mach-mau-von-xanh-canh-cua-but-pha-cho-doanh-nghiep-nho-va-vua-nam-2026-10026011322064026.htm

- Phần mềm quản lý doanh nghiệp hiệu quả phổ biến nhất hiện nay – MISA AMIS, truy cập vào tháng 1 17, 2026, https://amis.misa.vn/6469/phan-mem-quan-ly-doanh-nghiep/

- Trao giải thưởng “Sản phẩm Công nghệ số Make in Viet Nam” năm 2025, truy cập vào tháng 1 17, 2026, https://vjst.vn/trao-giai-thuong-san-pham-cong-nghe-so-make-in-viet-nam-nam-2025-77995.html

- Top 5 ERP software tốt nhất hiện nay tại Việt Nam 2025 (Cập nhật) – DEHA Digital Solutions, truy cập vào tháng 1 17, 2026, https://deha-soft.com/blog/top-5-erp-sofware/

- ERP là gì? Các phần mềm ERP hiện nay được ưa chuộng nhất Việt Nam – ITG Technology, truy cập vào tháng 1 17, 2026, https://itgtechnology.vn/phan-mem-erp/

- Phần mềm ERP phổ biến ở Việt Nam tốt nhất hiện nay, truy cập vào tháng 1 17, 2026, https://amis.misa.vn/1353/phan-mem-erp/

- Top 5 phần mềm ERP nguồn mở cho doanh nghiệp của bạn – Blog, truy cập vào tháng 1 17, 2026, https://blog.containerize.com/vi/top-5-open-source-erp-software-for-your-business/

- So sánh các phần mềm quản lý bán hàng hàng hàng đầu 2026 – Tino Group, truy cập vào tháng 1 17, 2026, https://tino.vn/blog/so-sanh-cac-phan-mem-quan-ly-ban-hang-hang/

- Hợp tác cùng Haravan, Payoo hỗ trợ doanh nghiệp SME thanh toán toàn diện, truy cập vào tháng 1 17, 2026, https://payoo.vn/tin-tuc/hop-tac-cung-haravan-payoo-ho-tro-doanh-nghiep-sme-thanh-toan-toan-dien.html

- 6 Bước Triển Khai CRM Hiệu Quả cho SMEs/Startup (Lộ Trình Thực Chiến) – CloudGO, truy cập vào tháng 1 17, 2026, https://cloudgo.vn/trien-khai-crm

- Xu hướng CRM năm 2026: Tương lai mới trong quản lý khách hàng – MISA AMIS, truy cập vào tháng 1 17, 2026, https://amis.misa.vn/104560/xu-huong-crm/

- MISA SME.NET 2026 – Phần mềm Kế toán Doanh nghiệp vừa và nhỏ, truy cập vào tháng 1 17, 2026, https://download.com.vn/misa-sme-net-2012-10092

- Tải phần mềm kế toán MISA SME 2026, truy cập vào tháng 1 17, 2026, https://sme.misa.vn/download/

- Nhận diện cơ hội và thách thức trong quá trình chuyển đổi số ở Việt Nam, truy cập vào tháng 1 17, 2026, https://hungyen.dcs.vn/nhan-dien-co-hoi-va-thach-thuc-trong-qua-trinh-chuyen-doi-so-o-viet-nam-c225113.html

- Chương trình đào tạo chuyển đổi số trực tiếp tại doanh nghiệp – CRC, truy cập vào tháng 1 17, 2026, https://crc.com.vn/giay-dep-chinh-hinh-nam/chuong-trinh-dao-tao-chuyen-doi-so-truc-tiep-tai-doanh-nghiep.aspx

- Chương trình đào tạo Chuyển đổi số trực tiếp tại doanh nghiệp nhỏ và vừa. – VDCA, truy cập vào tháng 1 17, 2026, https://vdca.org.vn/vi/chuong-trinh-dao-tao-chuyen-doi-so-truc-tiep-tai-doanh-nghiep-nho-va-vua

Khóa đào tạo Chuyển đổi số: Xu hướng mới trong vận hành doanh nghiệp để đột phá hiệu suất – Liên đoàn Thương mại và Công nghiệp Việt Nam, CN TP.HCM – VCCI-HCM, truy cập vào tháng 1 17, 2026, https://vcci-hcm.org.vn/su-kien-dao-tao/khoa-dao-tao-chuyen-doi-so-xu-huong-moi-trong-van-hanh-doanh-nghiep-de-dot-pha-hieu-suat/

Tiếng Việt

Tiếng Việt